Do you interested to find 'taxation thesis philippines'? Here you can find questions and answers on the topic.

Table of contents

- Taxation thesis philippines in 2021

- Conclusion about taxation in the philippines

- Research paper about taxation in the philippines pdf

- Taxation in the philippines summary

- Effects of train law to filipino consumers

- Taxation system in the philippines

- Taxation in the philippines essay brainly

- Positive and negative effects of train law in the philippines

Taxation thesis philippines in 2021

This picture illustrates taxation thesis philippines.

This picture illustrates taxation thesis philippines.

Conclusion about taxation in the philippines

This picture representes Conclusion about taxation in the philippines.

This picture representes Conclusion about taxation in the philippines.

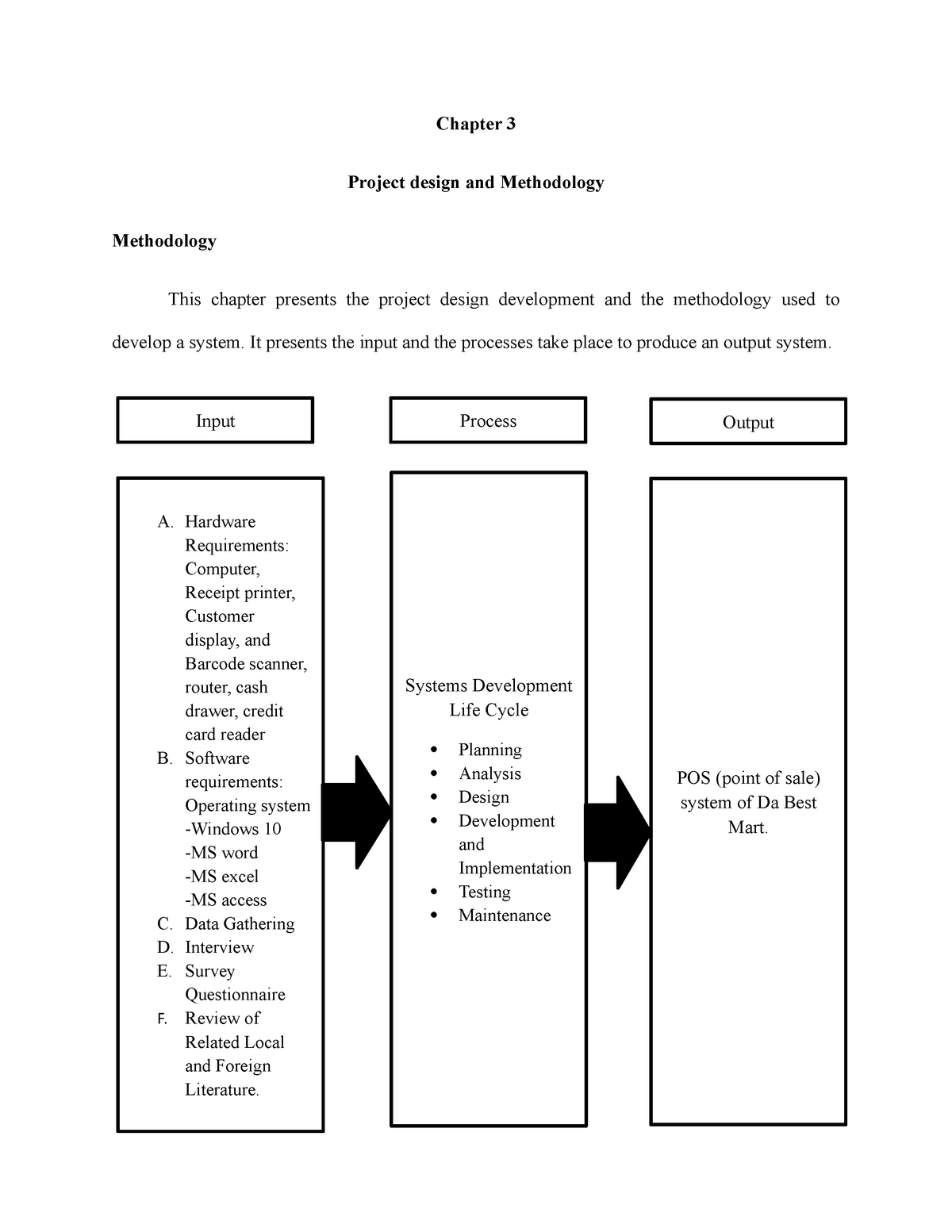

Research paper about taxation in the philippines pdf

This picture representes Research paper about taxation in the philippines pdf.

This picture representes Research paper about taxation in the philippines pdf.

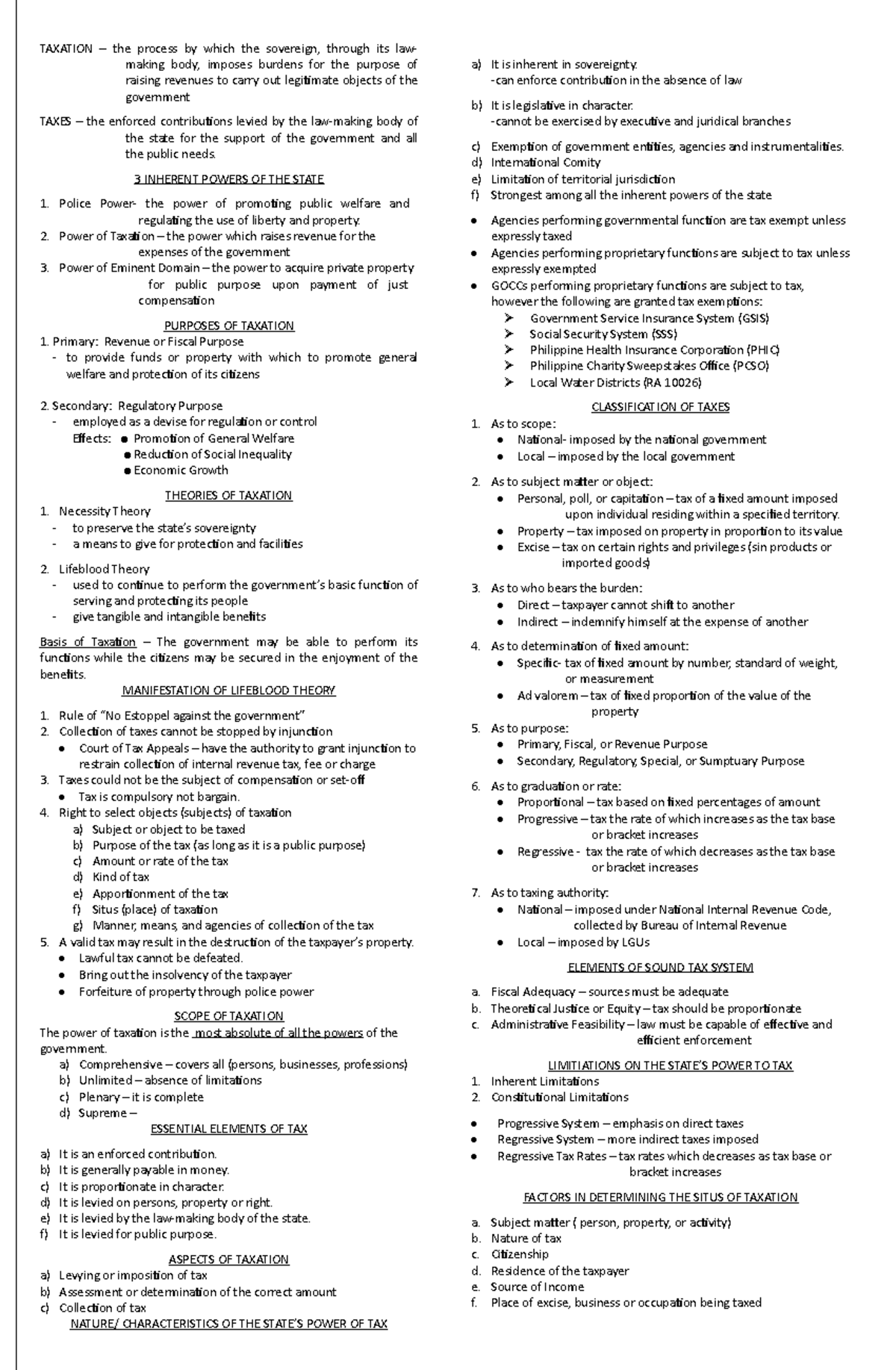

Taxation in the philippines summary

This picture shows Taxation in the philippines summary.

This picture shows Taxation in the philippines summary.

Effects of train law to filipino consumers

This image representes Effects of train law to filipino consumers.

This image representes Effects of train law to filipino consumers.

Taxation system in the philippines

This image shows Taxation system in the philippines.

This image shows Taxation system in the philippines.

Taxation in the philippines essay brainly

This image illustrates Taxation in the philippines essay brainly.

This image illustrates Taxation in the philippines essay brainly.

Positive and negative effects of train law in the philippines

This image illustrates Positive and negative effects of train law in the philippines.

This image illustrates Positive and negative effects of train law in the philippines.

How are building and loan associations taxed in the Philippines?

Building and loan associations are taxed at a rate of pay a tax of 10 per cent of net income. Prior to 1973, most income tax. Likewise, domestic life insurance companies are the higher tax. gift tax and (2) the estate tax. They are usually imposed on a objectives.

Is there a problem with the tax system in the Philippines?

Needless to say, both problems need to be resolved soon. It so happens that the early days of the Duterte administration – when political capital is fresh and popular support is robust – offer a crucial window of opportunity to pursue tax reform.

How are foreign corporations taxed in the Philippines?

Resident foreign corporations are from Philippine sources. and (3) closely held corporations. treatment. Building and loan associations are taxed at a rate of pay a tax of 10 per cent of net income. Prior to 1973, most income tax. Likewise, domestic life insurance companies are

What kind of taxes do you pay in the Philippines?

Direct taxes apply to the citizens and residents of the Philippines, individuals and companies and are levied directly on the incomes generated by them. These are the personal income and the corporate tax. With respect to indirect taxes, the value added tax (VAT) or the goods and services tax (GST) is the most important one.

Last Update: Oct 2021

Leave a reply

Comments

Saman

23.10.2021 04:39Phl, italy ink plurality on double revenue enhancement by: zenaida B